Our Program Structure

The Indian Banking industry, rather the entire BFSI sector has evolved over the decades. There is literally a metamorphosis that has happened in the banking industry in specific. This process of continuous change is on. The entire payment system has become almost digital, and so is the case with the assets and liability products. Most of the processes are becoming online. The convergence of banking and technology has brought tremendous convenience and lightning speed in the customer service space

Now, the customer is looking for a financial solution rather than a specific product. Banks have become financial supermarkets. They are providing banking services, financial services, mutual funds and insurance.

As a result, the current need of the banking industry is to have trained professionals in the areas of the entire range of financial solutions coupled with technical skills.

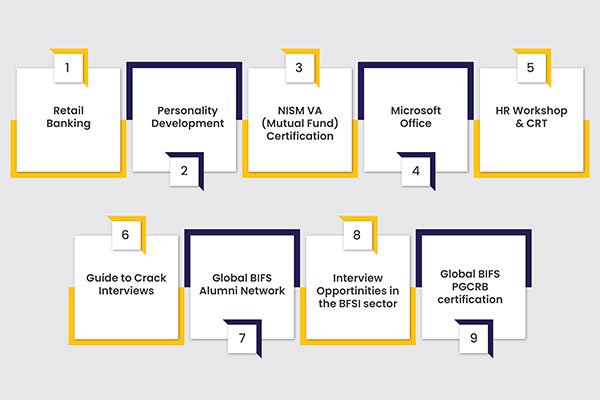

Our flagship Post Graduate Certificate in Retail Banking (PGCRB) program is designed to prepare recent graduates and postgraduates to become "Accomplished Bankers" by putting them through a comprehensive 300-hour training program delivered and mentored by ex-bankers with specialized knowledge in this field.

PGCRB gives students hands-on exposure - how to get new customers and to retain them. It provides a thorough understanding of the banking system's operations, products, and procedures. The program is full of role plays, case studies, and problem-solving techniques. Throughout the learning process, our highly qualified and skilled faculty serve as mentors.